Excel Compound Interest Formula: Easy Finance Guide 📈

Excel Compound Interest Deep Dive: Unlock Financial Growth 📊

Key insights

- Compound interest is the most common type of interest in finance, calculated on the initial principal and the accumulated interest from previous periods.

- To calculate compound interest in Excel, use the formula = P(1+R/T)^(NT), considering principal amount P, interest rate R, years N, and compounding times T per year.

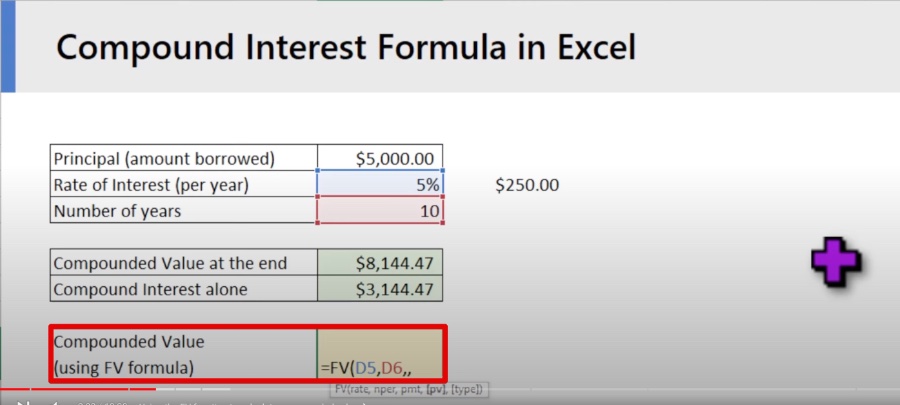

- The FV function in Excel helps calculate the future value of an investment, considering the interest rate, number of periods, payments per period, present value, and the timing of payments.

- Understanding compounding effects is crucial, including comparing simple vs. compound interest over time, effects of interest rates, compounding with regular payments, and the reverse of compounding using goal seek.

- A sample workbook is available for download to learn more about compound interest calculations in Excel, enhancing real-life financial application.

Compound Interest in Excel

Compound interest represents a fundamental concept in finance, essential for calculating the growth of investments and savings over time. This interest type accounts for both the initial amount invested or borrowed (the principal) and the interest that accumulates over periods of investment. Excel's capabilities in dealing with compound interest calculations make it an indispensable tool for financial analysis and planning.

The formula used in Excel for compound interest calculations, = P(1+R/T)^(NT), along with the FV function, simplifies the process of understanding how one's investments will grow under different scenarios. For example, adjusting the period of compounding from annual to quarterly or monthly can significantly affect the outcome, showcasing the power of compound interest over time.

The video by Chandoo simplifies the concept of compound interest, which is the interest earned on both the initial principal and the accumulated interest. This type of interest, often referred to as "interest on interest," is frequently used in finance. Chandoo explains how to calculate compound interest in Excel using a specific formula.

To compute compound interest in Excel, you need the principal amount (P), the interest rate (R), the number of years (N), and the number of times interest is compounded per year (T). The formula used is = P(1+R/T)^(NT), which helps calculate various compound interest values effectively.

The video covers different topics related to compound interest calculations in Excel, including using the FV function for calculating compounded value, comparing simple versus compound interest over time, and understanding the impact of interest rates on compounded value. Additionally, it discusses compounding with regular payments, such as monthly, and introduces the reverse of compounding using the goal seek feature in Excel.

People also ask

How do you calculate compound interest in Excel?

Answer: In Excel, to compute compound interest, two primary formulas can be applied. The first one is =P*(1+r/n)^(n*t), with 'P' representing the principal sum, 'r' the interest rate, 'n' the number of times interest is compounded per period, and 't' the duration of the investment. It's essential to ensure that both the compounding period and the interest rate are aligned in their timeframe.How to calculate simple interest and compound interest in MS Excel?

Answer: For this operation, you continue by adding another multiplication operation, followed by selecting the time duration cell B3 through a left click. Subsequently, proceed with the calculation.What is the spreadsheet function for compound interest?

Answer: The FV (Future Value) function in Excel is employed for calculating compound interest. This function calculates the future value of an investment given a specified rate of constant interest over a number of periods with consistent, periodic payments. Within the FV function's parameters, 'Rate' refers to the steady interest rate applied each period.What is the formula for simple interest and compound interest?

Answer: The formula for calculating simple interest is given by PRT, while the compound interest is determined using the formula P(1 + R)T - P, where 'P' indicates the principal amount, 'R' the rate of interest, and 'T' the time duration of the investment.

Keywords

Compound Interest Formula Excel, Excel Finance Concepts, Simplified Finance Excel, Compound Interest Excel Tutorial, Finance Formulas Excel, Excel Investment Calculator, Compound Interest Spreadsheet, Learn Compound Interest Excel